Federal Reserve decisions have a significant impact on mortgage rates, primarily through their influence on the broader economy and the yield of Treasury securities.

Federal Funds Rate

This is the interest rate at which depository institutions lend their reserve balances to other depository institutions overnight on an uncollateralized basis. While the Federal Reserve doesn’t set mortgage rates directly, changes to the federal funds rate often lead to changes in other interest rates in the economy, including those on fixed-rate and variable-rate mortgages.

Increase in Federal Funds Rate: When the Federal Reserve increases the federal funds rate, it typically leads to higher borrowing costs across the economy. As a result, interest rates on new fixed-rate mortgages may increase as lenders adjust rates to maintain their profit margins and account for the higher cost of borrowing.

Decrease in Federal Funds Rate: Conversely, when the Fed lowers the federal funds rate, it's usually aimed at spurring economic activity by making borrowing cheaper. Mortgage rates might decrease in response, making it less costly to finance home purchases or refinance existing mortgages.

Treasury Yields

Mortgage rates are closely tied to the yields on U.S. Treasury securities, particularly the 10-year Treasury note. The Federal Reserve’s open market operations, including the buying and selling of government securities, influence the supply and demand dynamics of Treasury bonds, which in turn affect their yields.

Quantitative Easing (QE): A policy often enacted during economic downturns where the Fed buys large amounts of securities to inject liquidity into the economy. QE can drive down long-term interest rates, including mortgage rates, as it increases the supply of money, bidding down yields on Treasuries.

Quantitative Tightening (QT): Conversely, as the Fed sells securities, it can lead to higher yields on Treasury bonds and consequently, higher mortgage rates.

Market Expectations

Investors' expectations of inflation and future Fed rate changes also influence mortgage rates. If the market expects that the Fed will hike rates to combat rising inflation, lenders might increase mortgage rates in anticipation to protect their margins.

Conclusion

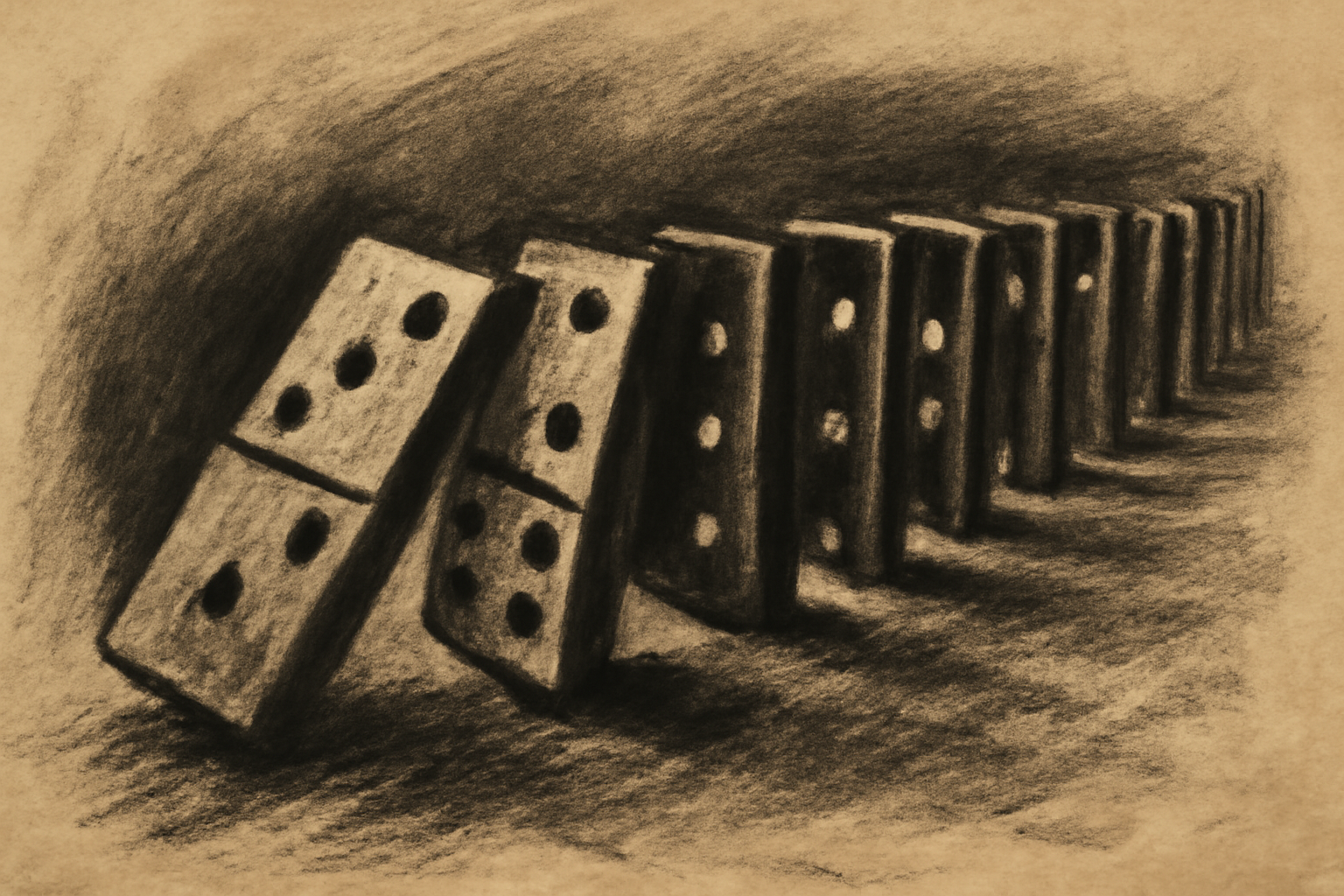

Ultimately, while the Fed does not set mortgage rates, its monetary policy creates ripple effects throughout the economy that influence interest rates on mortgages. Understanding these mechanisms helps borrowers make informed decisions about home financing, keeping an eye on federal announcements and market reactions to maintain an advantageous financial strategy.

Related reading: bond yields and mortgage pricing and rate lock strategies.